Toronto New Condo Sales at All-Time Low, Causing Construction to Halt

Business • May 6, 2025

According to Greater Toronto Hamilton Area (GTHA) new condo sales have declined 62% percent last year, causing major issues in new construction projects.

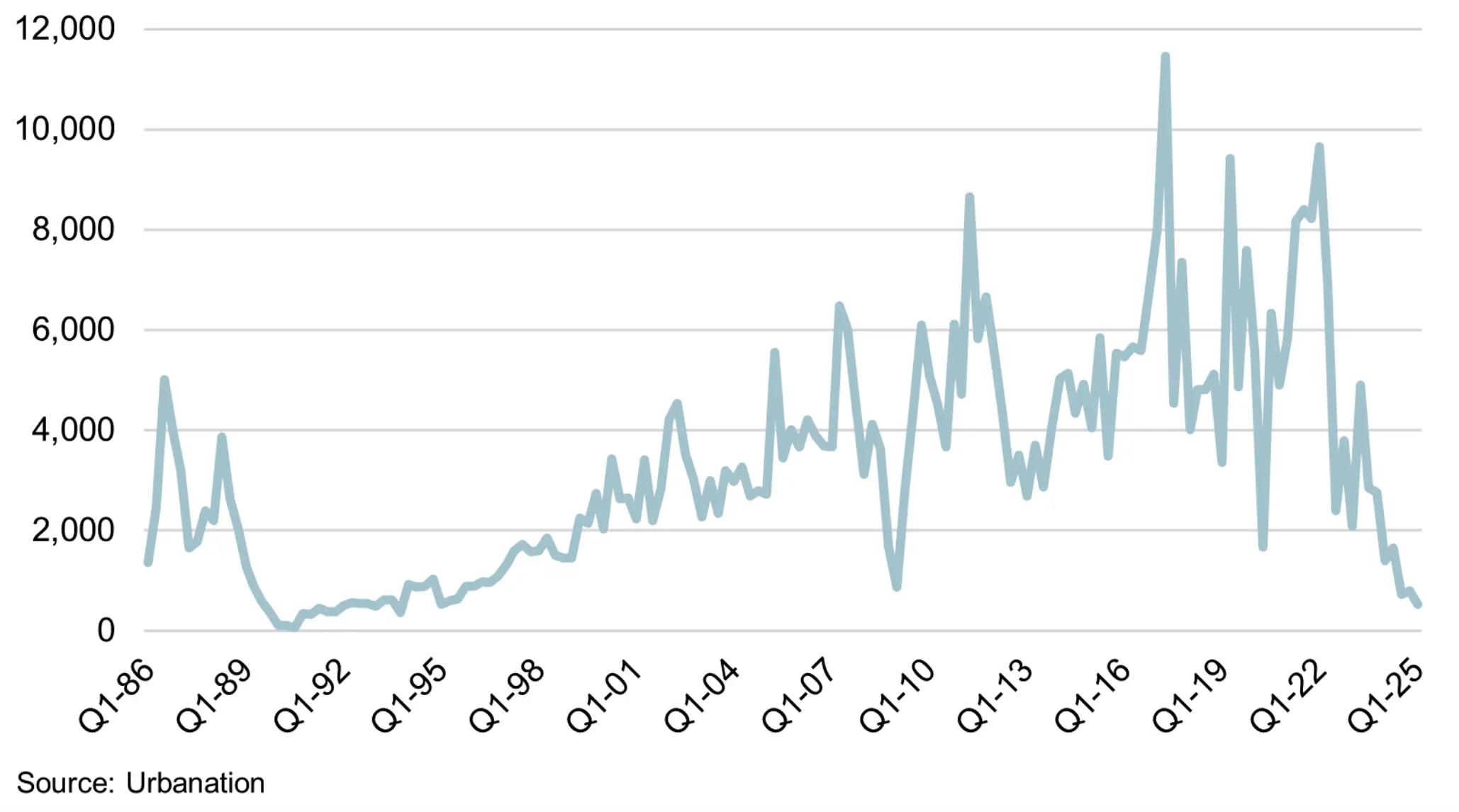

Toronto's condo market is experiencing an all-time slowdown, with unsold inventory at record levels in decades. According to Urbanation Inc., the Greater Toronto Hamilton Area (GTHA) saw just 533 new condo sales in Q1 2025—a 62% drop year-over-year and 88% below the 10-year average. This represents the worst quarter since 1995.

Just 215 new condo units were sold within the City of Toronto in the same timeframe, a record low since 1990. Two presale projects just came online during Q1 for a combined 275 units. Since the beginning of 2024, 28 projects with 5,734 units either were placed in receivership, cancelled, converted to rental use, or shelved.

Unsold new condo stock has increased to 23,918 units—6% higher than last year and 58% higher than the 10-year average. Urbanation reports that this represents 78 months of supply, more than seven times the balanced level of 10 to 12 months. The unsold units are found in all stages of developments: pre-construction, under construction, and completed developments.

The combined total of finished and still to be sold condo units has been more than doubled from last year. The number will further increase with an additional 2,411 units still unsold to be finished by the end of the year. These are not included for any other pre-sold units which failed to close.

Excess inventory is also forcing builders to make generous concessions, including settlement cashback, rental guarantees, and longer-than-usual deposits. Closing prices on units that sold averaged 7% below a year earlier at $1,151 per square foot (psf). Unsold inventory listed at $1,339 psf averaged was still above this, reflecting lingering disconnect between demand from buyers and builder requirements.

Construction activity has also plummeted. Just 497 new condo units began construction in Q1 2025—a 79% decline from the previous year and 88% lower than the 10-year average. This is the lowest rate of construction since 1996.

Although condo completions dropped 16% below previous record levels last year, they were still 67% higher than the 10-year average at 9,495 units in Q1. Urbanation forecasts completions to hit an all-time high of 31,396 units in 2025 before easing to 17,487 in 2026. Units under way have dropped a third in the last two years to 69,042.

Ron Butler, owner and principal broker of Butler Mortgage, blames the scenario on decades of over-construction, especially of mini-units. The majority of the unsold condos are less than 500 square feet and were constructed specifically with investors in mind—not families. Butler estimates a 30% pre-construction closing default rate in Toronto, with buyers walking away and leaving deposits behind.

In GTA suburbs, the effect is stronger. Prices in Durham, York, and Peel regions have fallen by as much as 15% to 20%. Hamilton and Niagara also have witnessed significant falls.

Urbanation cautions the condo market is experiencing its toughest times yet. The extended downturn, along with high prices and trade uncertainty, have the potential to seriously affect long-term supply of housing. With over half of Toronto's new housing in the form of condominiums, the effects of this slowdown could be felt well into the future.